Lessons from recent Company Reporting

The last year was yet another reminder of just how hard it is to time markets. Just when everyone was most gloomy about inflation and interest rates, share markets rebounded.

The Australian economy has been resilient due to the tailwinds of a recovery in population growth, relatively high commodity prices and low unemployment. However, there are signs of downside risks building as rising interest rates have a lagged impact on mortgage customers and other cost of living pressures become a financial strain for more Australians.

Against this backdrop key takeaways from recent company reporting:

- Companies with PRICING POWER outperformed.

- Cost inflation was a hallmark as higher wages, interest rates, and tight labour markets, threaten margins over the next 12 months.

- Capex boom underway globally, including Australia in strategic commodities, via the US Inflation Reduction Act, Europe, China and many other countries and regions due to decarbonisation.

- Lags associated with higher interest rates just beginning to impact, especially consumers.

- Global cyclicals benefitting from a lower Australian Dollar.

- Overall guidance was cautious and vague. This is consistent with recent years.

- Globally, Generative AI looks set to drive a new wave of productivity.

Economic theme driving the market

Every year has a major economic theme that drives the market. In 2020 it was the COVID-19 induced recession. 2021 was policy supported reflation. Last year worries about inflation, recession and geopolitics drove poor returns in 2021-22. A relaxation of worries about these things drove a strong rebound in returns over the last financial year: While inflation rose to its highest in decades in 2022, it peaked in the US a year ago and has been trending down since with other countries following suit. This reflects improved goods supply, lower commodity prices, lower transport costs and easing demand. This should enable central banks to start easing monetary policy through next year.

Economic outlook

The outlook for the Australian economy is mixed. The RBA initially expected the cash rate to be raised anywhere from 3.5% to 4%, currently it is 4.10%. While central banks still worry about sticky services inflation in the face of stronger wages growth, signs of cooling economic growth and slowing job openings have started to ease concerns on this front.

Chart 1 - Cash Rate Outlook –Rate cuts expected to start somewhere between March and September 2024

Source – ABS, RBA and CBA Global Economic and Markets Research

Labour markets remain very tight. The unemployment rate has been stable around 3.70% but remains below the RBA’s natural rate of unemployment of around 4.25%. The number of unemployed workers per vacancy remains very low at 1.2, far below the pre-pandemic level of around 3. With net immigration expected to close to 400,000 in FY 24, tight conditions in the labour market should ease somewhat. Unemployment is expected to rise, with some forecasts as high as 4.6% by the end of 2024.

Long term, Australia is better positioned than most countries given it is a net exporter of food, has extensive thermal coal, gas, iron ore resources, green minerals (lithium, copper, nickel) and strong population growth. Case in point Australian resource and energy exports climbed 9% to a record A$460 billion ($300 billion) in the financial year just ended. This was a major contributor to the budget surplus of A$22.1 billion ($14.16 billion) for the year to June 2023.

During the 2023 Financial Year Australian residential property prices fell 5.3%, reflecting a sharp fall in the second half of 2022 as higher mortgage rates hit. The market saw some recovery in the last 6 months as immigration rebounded and supply fell. CoreLogic noted ‘persistently low levels of available housing supply running up against rising housing demand’. Rising rents also support price rises. There is a need for an increase in housing construction.

Interest rates & inflation

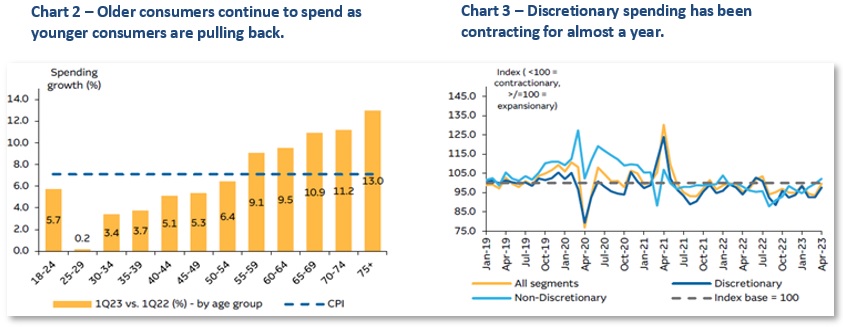

The two-speed consumer. Discretionary spending under pressure due to the impact of rising interest rates.

Official data from the ABS, as well as third-party data from Visa suggests that discretionary spending is under pressure as the impact of interest rate increases are being felt. Younger age groups including renters and first-time homeowners are the most affected, as rising rent and interest payments hit household budgets. Data from the CBA shows that spending for those aged 18-54 is below inflation, implying volumes are declining. Those over 54 continue to spend as income from savings is boosted by the higher interest rates.

Source – Visa, Macquarie Research

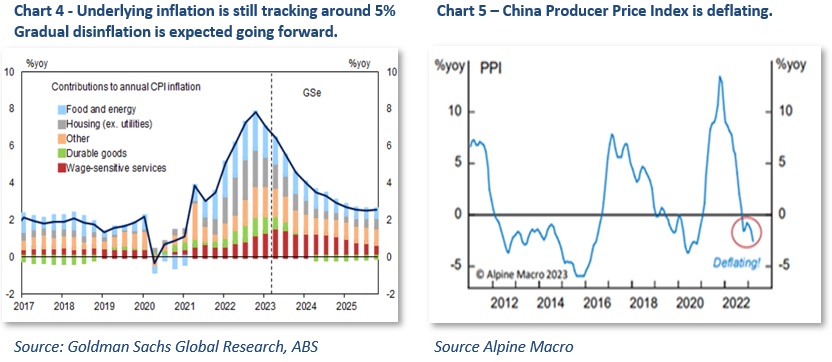

Easing inflation has been driven by goods prices but is still too high.

Inflation in most major economies is moderating. In Australia, inflation pressures have eased over recent months but still remain too high. Housing inflation remains elevated, due to an acceleration in rents. Inflation is also strong across a range of services including education, medical services, and insurance, while goods inflation eased in part due to disinflation in globally traded goods such as furniture and household appliances. China remains the largest Global Manufacturer. China Producer Price Index is deflating which is positive for future global goods-based inflation.

Investment Strategy

There are always opportunities in Stock/Sector Selection. In the Australian market we continue to hold a balanced portfolio structure across Growth (Information Technology, Logistics, Healthcare, International), Defensives (Consumer Staples, Infrastructure, Gold) and Cyclicals (Resources, select Financials).

.svg)